Gold Silver Resources (GSR2u.com.my) VS Publicgold VS GoldSilver2u.com

Here is an interesting development in our local scene lately. We have a new comer in providing locally branded silver by Gold Silver Resources Sdn Bhd.

^ GSR2u.com.my is by Gold Silver Resources Sdn Bhd Malaysia – Screen captured on 11-Feb-2012

Gold Silver Resources’ Background

Gold Silver Resources Sdn Bhd is a privately held company founded on 16 November 2011 and headquartered in Shah Alam. GSR is the initial for the company and just like how Tomei did it, they appended “2u.com.my” for their web address to make it truly Malaysian. With that, we have gsr2u.com.my. They product offering includes silver bars, silver rounds and gold jewelry.

^ Truly Malaysian – The Bunga Raya Malaysia and Harimau Malaya 1oz Silver Bar by GSR2u.com.my

GSR took the extra effort in making silver bars with local appearance. Currently, they have silver bars with Bunga Raya and Harimau Malaya emblem. They are scheduled to have Rhinoceros Hornbill and Dragon 1oz silver coins by sometime in February. Looks like GSR is also herding on the Dragon boat for 2012! Apart from that, they also have silver bars with various weight from 100 gram to 1 kilogram.

GSR’s Spot Price and Spread check!

Let’s do a quick calculation on GSR’s spot price and spread. At the time of writing, the silver spot price is USD33.59/ozt which is approximately RM102.90/ozt.

Before that, let’s review back the formula to calculate above spot price and spread. Alternatively, you can use our Silver Spot calculator which is conviniently placed on the right side of this blog.

Two Steps in Calculating Above Spot Price %

Step 1) Get Live Silver Price.

Formula: Live Silver Price = Silver Spot Price X WeightStep 2) Getting the Above Spot Price %

Formula: (Silver Retail Price – Live Silver Price)/Live Silver Price X 100%Buyback Spread % Formula

Formula: (Silver Retail Price – Buyback Price)/Buyback Price X 100%

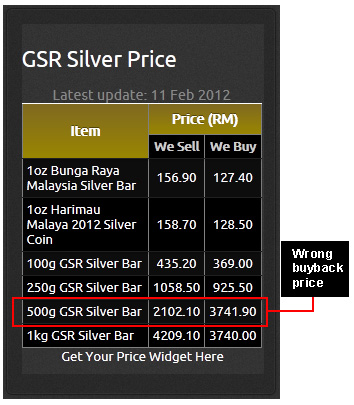

Now, let’s refer to GSR2u.com.my for their latest silver pricing and start punching our calculator.

^ At time of capturing, the buyback for 500g GSR silver bar was priced wrongly

… and GSR’s Spot Price and Spread is… (drumroll!)

| # | Product | Above Spot % | Buyback Spread |

|---|---|---|---|

| 1. | 1oz Bunga Raya Malaysia Silver Bar | 52.5% | 23.2% |

| 2. | 1oz Harimau Malaya 2012 Silver Coin | 54.2% | 23.5% |

| 3. | 100g GSR Silver Bar | 31.6% | 17.9% |

| 4. | 250g GSR Silver Bar | 28.0% | 14.4% |

| 5. | 500g GSR Silver Bar | 27.1% | Unavailable |

| 6. | 1kg GSR Silver Bar | 27.3% | 12.5% |

The 1oz Bunga Raya silver bar and Harimau Malaya silver coin are a premium to buy at 50%+ over spot. Bare in mind this is without legal face value. In comparison, imported international recognized silver coins with legal face value such as American Eagles and Canadian Maples are usually around 45% over spot in Malaysia.

GSR2u.com.my VS PublicGold.com.my VS GoldSilver2u.com Comparison Worksheet

Moving forward, lets compare GSR’s standing with competitors of the same league. I’ve done a comparison worksheet using excel with screen capture of price offered by PublicGold and GoldSilver2u.com for your reference. All prices from respective company are captured at the same time of writing – with silver price calling for USD$33.59.

^ Screen shot of spot price and spread comparison in Excel

Click here to download my Excel spreadsheet for free. Virus free.

BuySilverMalaysia.com

While I too, runs a webstore selling imported silver bullion, my webstore is family owned and is at no par with them – at least for now. It is good to see how Malaysia is shaping up for Silver. It is tremendously exciting to see new players coming into picture. Bring it on!

Further readings:

You may be interested in the following articles I previously wrote:

PublicGold’s Spot Price:

investsilvermalaysia.com/how-much-is-publicgolds-silver-spot-price/GoldSilver2u.com’s Spot Price:

investsilvermalaysia.com/how-much-is-goldsilver2u-coms-silver/Understanding Spread for Buying and Selling:

investsilvermalaysia.com/understanding-spread-for-buying-and-selling-gold-or-silver/Silver Spot Calculator:

investsilvermalaysia.com/goldsilver-spot-price-calculator/Understanding Weight for Precious Metals:

investsilvermalaysia.com/ounce-troy-ounce-grams-dinar-dirham-and-tael/

There's 11 Comments So Far

February 19th, 2012 at 3:57 pm

Thanks for this very useful website for us Malaysians! I’ve been thinking about investing in silver and over the past hour I’ve gained more information from here than I had over the past few weeks. The various options that you mentioned here have helped me to gain a better understanding of where to go to and what exactly to buy. Keep up the good job!

February 19th, 2012 at 4:13 pm

And another thing: it is commendable that you have willingly shown us all the Malaysian outlets available for the buying and selling of these precious metals despite the fact that you also have a similar business. Most other people might not be so forthcoming in sharing this information. This says a lot about you as a person.

February 19th, 2012 at 9:56 pm

Thanks Mat Cendana for your kind comments. All the best in your investment! Cheers!

February 22nd, 2012 at 4:51 pm

I’m sorry, I’m a little confuse on how to calculate the spread.

In a post back in 17 July 2011 you used to divide the Silver Retail Price and not the Buyback Price you used here.

Can you please clear this up for us? Thanks 😉

February 23rd, 2012 at 9:29 am

Hi KY,

I am not sure which part of my previous post “Understanding Spread for Buying and Selling Gold or Silver” you are refering to. However, the formula remains that for buyback, you divide it with the price you paid for it, which is the retail price. I hope this helps.

March 4th, 2012 at 8:54 am

KY,

You are right. My formula was inaccurate. You have to divide it with buyback price instead of retail price. Sorry for the confusion. I have corrected my previous errors. Thank you for highlighting.

February 29th, 2012 at 11:11 am

Well talking about GSR silver premium product, I do agree a bit pricey if premium is considered. In my opinion, we are importing raw at higher price already + producing cost. I do have discussed with the GSR CEO how to reduce the total cost in the future so that it will become more competitive.

Even more there are producing in limited mintage. Say, 10z Rhino Hornbill only 30K available while 1oz Bunga Raya & Malaya Tiger with 100k mintage respectively.

GSR is acquiring an industrial silver extractor from India to extract from industrial & houshold wastage/dumps.

February 29th, 2012 at 12:41 pm

Thank you Shukri for sharing the information. Personally, I may not think that limited mintage will work considering we have a few players with limited mintage on the international level. IMHO: GSR’s presense is now based only in Msia, it would take a while before the limited mintage can take off 🙂

March 12th, 2012 at 2:36 pm

Good info, it would be better if you can add the new comer My Smart Gold

http://mysmartgold.gotdns.org/Liverate/Home/Liverate, it has the lowest spread, if i calculate using your excel ;p

March 12th, 2012 at 8:34 pm

Lai: Thanks for sharing!

January 11th, 2013 at 9:19 pm

gud info. and fair comparison indeed. make me ponder.