Inflation is Compounding Interest Working Against You

In this article, I am going to illustrate to you how compounding interest works and how is it stealing your money at an exponentiation rate without you even knowing it.

What is Compounding Interest

Compounding interest means repeating the process of generating income on interest earn over a period of time.

Compounding interest means repeating the process of generating income on interest earn over a period of time.

For instance: RM100k principal cash into fix deposit for 20 years with an annual interest of 3%.

For the first year, your fix deposit will generating 3%. This will get you RM3,000 interest from your RM100,000 principle you initially put down. Upon maturity, renew contract again for another year but this time, instead of just RM100,000 – lay down RM103,000 (RM100,000 + interest generated from previous year) as principle.

By year two, you will have RM3,090 interest (RM103,000.00 X 3% = RM3,090). We have generated a noticeable amount of RM90 more in interest earned comparing to your first year. You now have RM106,090 (RM103,000 + RM3,090). Repeat the process of renewing your FD for the next 18 years.

So, how much will you be getting back? Give it a random estimate. Answer will be coming right up next!

Formula for Compounding Interest

The magic formula for compounding interest is as followed:M = P( 1 + i )n

M is the final amount including the principal.

P is the principal amount.

i is the rate of interest per year.

n is the number of years invested.

Continuing from our working example above, we have now have 100,000 as P (RM100,000 as principal amount), 0.03 as i (3% interest per year) and 20 as n (20 years of tenure). Apply the numbers into the formula.

M = RM100,000 (1 + 0.03)20

Hence, here is your answer. If you leave your RM100k principal into a fix deposit scheme running at 3% per annum and forget about it for 20 years, at the end of the contract term, your interest plus capital is:

RM180,611.12.

That is over 80.6% positive gain for doing nothing, really.

Compounding Interest for Inflation

Every year, our Ringgit is devalue by a rate over and over again. This rate is called, inflation rate. Compounding interest formula works for calculating inflation as well. The only catch now is, it is working against you.

Instead of using positive number for interest in the formula, use negative to represent inflation. For instance, if you would like to illustrate how RM100,000 would look like 20 years later with an inflation rate of 3%, replace “i” with -0.03 to represent -3%.

By having negative, the entire compounding interest formula will flip towards negative gearing.

With inflation rate of just 3% a year, RM100,000 will lose nearly half its original value within 20 years to RM54,379.43.

With inflation rate of just 5% a year, RM100,000 will dilute 74.2% of its value within 20 years to RM35,848.59.

According to Malaysian Statistical Department, our official inflation rate for 2012 up to November is on average 1.90%. You and I know that the given numbers are unrealistic.

Fool’s Way to Calculate Realistic Inflation Rate

How many times have you heard this: Fix deposit rate is insufficient to cover inflation loss?

^ Current fix deposit offering for December 2012 – Source: Malaysia.deposits.org

This is because fix deposit rate was never designed to outpace inflation.

Based on that fact, using bank’s 12-month fix deposit rate would be the simpliest way to give an estimate on true minimum inflation rate.

Today’s rate for 12-month fix deposit is on average 3.15%. That is your minimum inflation rate.

The question now is, how much do you think the actual inflation rate is?

3%? or 5% or 8%?

Reality is, inflation rate can be multiple fold over the minimum inflation rate above.

When Compounding Interest is Working Against You

Here is a populated table with inflation projection on how much RM100,000 would worth after x period of year. This chart shows how erosive inflation can be:

| Annual Inflation Rate | -3% | -5% | -8% | -10% |

|---|---|---|---|---|

| 2 years | $94,090.00 | $90,250.00 | $84,640.00 | $81,000.00 |

| 5 years | $85,873.40 | $77,378.09 | $65,908.15 | $59,049.00 |

| 10 years | $73,742.41 | $59,873.69 | $43,438.85 | $34,867.84 |

| 15 years | $63,325.12 | $46,329.12 | $28,629.74 | $20,589.11 |

| 20 years | $54,379.43 | $35,848.59 | $18,869.33 | $12,157.67 |

| 25 years | $46,697.47 | $27,738.96 | $12,436.43 | $7,178.98 |

| 30 years | $40,100.71 | $21,463.88 | $8,196.62 | $4,239.12 |

This explains why your grandma nags about how necessity goods are more expensive today. More money is now required to purchase equilavent amount of product that used to be cheap.

This is what inflation do – stealing wealth at compounding rates. Your grandma’s purchasing power have been quietly stolen away by inflation.

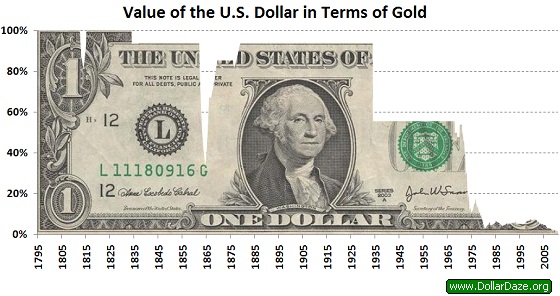

Value of USD$: Shinking Like a Rock

No matter which way you look at it; there is no paper currency in this world that has the capacity to escape from inflation. United State lost an estimated 98% of its currency value since the day they unpegged their gold standard in 1971.

If “big brother” of all currency is losing 98% of its original value, how much would it impact our Malaysia Ringgit?

During this same period of time (1971 – 2012), gold rocketed from USD35 an ounce to USD$1740 an ounce while silver soared from USD$1.88 an ounce to today’s USD$34 an ounce.

Bottom Line

Start protecting your purchasing power. Convert your depreciating paper to real asset today.

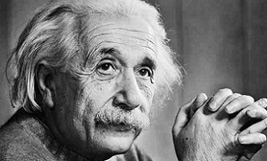

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein

For Further Readings:

http://www.investopedia.com/video/play/what-is-inflation/

http://www.thepracticalway.com/2011/06/21/compound-interest/

http://math.about.com/od/formulas/a/compound.htm

There's 0 Comment So Far